Assured Guaranty [Cover Art to Follow] 2018 Annual Meeting of Shareholders and Proxy Statement

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under§240.14a-12 | |

Assured Guaranty Ltd.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. | |||

Assured Guaranty [Cover Art to Follow] 2018 Annual Meeting of Shareholders and Proxy Statement

| DEAR SHAREHOLDERS: | March |

It is with great pleasure that we invite you to our 20182020 Annual General Meeting of shareholders on Wednesday, May 2, 2018,6, 2020, at 6 Bevis Marks in London. Whether or not you plan to attend the meeting in person, please vote your shares; your vote is important to us.

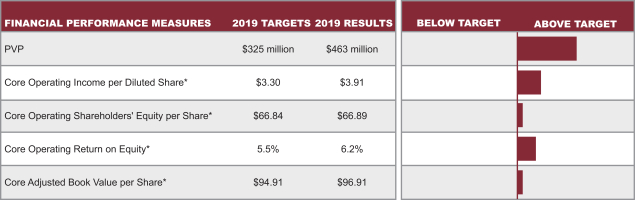

Assured Guaranty’s 20172019 financial performance was excellent. Our shareholders’ equity attributable to Assured Guaranty Ltd. per share,non-GAAP adjusted operating shareholder’s equity per share1andnon-GAAP adjusted book value per share1 all reached record levels, at $58.95, $56.20$71.18, $66.96 and $77.74,$96.86, respectively. These records reflectIn addition, we will look back on 2019 as the great stridesyear we continuedtook our first significant step to make onestablish our four main strategies:asset management business, Assured Investment Management, by acquiring BlueMountain Capital Management, LLC, which we refer to as BlueMountain, and associated entities.

Some of the highlights from our year include:

| • |

|

| • |

|

| • |

|

| • |

|

We provide further detail about our accomplishments and plans for the future in the Letter to Shareholders accompanying our 2017 Annual Report. We encourage you to review that letter and our 2017 Annual Report, as well as the Proxy Statement that follows this letter.

We look forward to another successful year.

Sincerely,

|

| |

|

|

| 1 |

|

| 2 | As reported by Creditflux for the fourth quarter of 2019. |

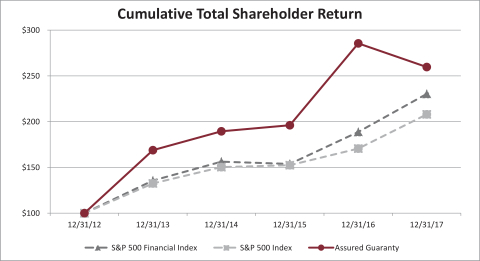

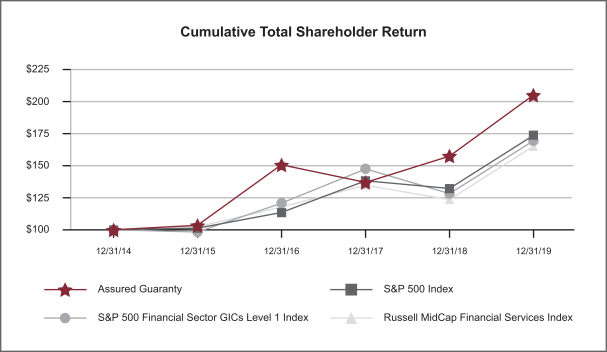

The market rewarded us for our accomplishments with a 30% total shareholder return for the year, double last year’s return. We provide further detail about our 2019 accomplishments and our plans for the future in the Letter to Shareholders accompanying our 2019 Annual Report, which we encourage you to review.

Finally, a word about the COVID-19 pandemic and its consequences. We offer our support and well wishes for the safety of all affected. Assured Guaranty is operating well remotely, as contemplated in the business continuity plan that we test regularly, and we are providing the services and communications we normally would. We believe the benefits of our value proposition are clearly evident in the volatile market environment we are now experiencing. We have the financial strength to fulfill our commitments, and preserving that financial strength is our highest strategic priority.

Sincerely,

|  | |

Francisco L. Borges | Dominic J. Frederico | |

| Chairman of the Board | President and Chief Executive Officer |

March 21, 201825, 2020

Assured Guaranty Ltd.

30 Woodbourne Avenue

Hamilton HM 08

Bermuda

NOTICE OF ANNUAL

GENERAL MEETING

TO THE SHAREHOLDERS OF ASSURED GUARANTY LTD.:

The Annual General Meeting of Assured Guaranty Ltd., which we refer to as AGL, will be held on Wednesday, May 2, 2018,6, 2020, at 8:1:00 a.m.p.m. London Time, at 6 Bevis Marks, London, EC3A 7BA, United Kingdom, for the following purposes:

| 1. | To elect our board of directors; |

| 2. | To approve, on an advisory basis, the compensation paid to AGL’s named executive officers; |

| 3. | To appoint PricewaterhouseCoopers LLP as AGL’s independent auditor for the fiscal year ending December 31, |

| 4. | To direct AGL to vote for directors of, and the appointment of the independent auditor for, its subsidiary Assured Guaranty Re Ltd.; and |

| 5. | To transact such other business, if any, as lawfully may be brought before the meeting. |

Shareholders of record are being mailed a Notice Regarding the Availability of Proxy Materials on or around March 21, 2018,25, 2020, which provides shareholdersthem with instructions on how to access the proxy materials and our 20172019 annual report on the Internet, and if they prefer, how to request paper copies of these materials. At this writing, the novel Coronavirus responsible forCOVID-19 continues to spread and governments are taking various actions in response. If we postpone or change the time or location of our Annual General Meeting, we will issue a press release that we will make available on our website atwww.assuredguaranty.com/annualmeeting and file with the Securities and Exchange Commission (which we refer to as the SEC) as definitive additional proxy material. If you wish to receive a physical copy of any such press release, please contact our Secretary at generalcounsel@agltd.com or (441)279-5725.

Only shareholders of record, as shown by the transfer books of AGL, at the close of business on March 8, 2018,13, 2020, are entitled to notice of, and to vote at, the Annual General Meeting.

SHAREHOLDERS OF RECORD MAY VOTE UP UNTIL 12:4:00 NOONP.M. EASTERN DAYLIGHT TIME ON MAY 1, 2018.5, 2020. BENEFICIAL OWNERS MUST SUBMIT THEIR VOTING INSTRUCTIONS SO THAT THEIR BROKERS WILL BE ABLE TO VOTE BY 11:59 P.M. EASTERN DAYLIGHT TIME ON April 30, 2018.MAY 4, 2020.

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL GENERAL MEETING IN PERSON AND REGARDLESS OF THE NUMBER OF SHARES YOU OWN, PLEASE VOTE AS PROMPTLY AS POSSIBLE VIA THE INTERNET OR BY TELEPHONE. ALTERNATIVELY, IF YOU HAVE REQUESTED WRITTEN PROXY MATERIALS, PLEASE SIGN, DATE AND RETURN THE PROXY CARD IN THE RETURN ENVELOPE PROVIDED AS PROMPTLY AS POSSIBLE. IF YOU LATER DESIRE TO REVOKE YOUR PROXY FOR ANY REASON, YOU MAY DO SO IN THE MANNER DESCRIBED IN THE ATTACHED PROXY STATEMENT. FOR FURTHER INFORMATION CONCERNING THE INDIVIDUALS NOMINATED AS DIRECTORS, THE PROPOSALS BEING VOTED UPON, USE OF THE PROXY AND OTHER RELATED MATTERS, YOU ARE URGED TO READ THE ATTACHED PROXY STATEMENT.

By Order of the Board of Directors,

Ling Chow

Secretary

|

|

| 1 | ||||

| 3 | ||||

| 3 | ||||

| 4 | ||||

| 5 | ||||

| 9 | ||||

Compensation Committee Interlocking and Insider Participation | ||||

| ||||

| INFORMATION ABOUT OUR COMMON SHARE OWNERSHIP | ||||

How Much Stock Is Owned By Directors and Executive Officers? | ||||

| 26 | ||||

| 43 | ||||

| 46 | ||||

| 47 | ||||

| EQUITY COMPENSATION PLANS INFORMATION | ||||

PROPOSALS CONCERNING OUR SUBSIDIARY, ASSURED GUARANTY RE LTD. | ||||

| SHAREHOLDER PROPOSALS FOR | ||||

How do I submit a proposal for inclusion in next year’s proxy material? | ||||

How do I submit a proposal or make a nomination at an Annual General Meeting? | ||||

| INFORMATION ABOUT THE ANNUAL GENERAL MEETING AND VOTING | ||||

PROXY STATEMENT

| Assured Guaranty Ltd. | March |

This summary highlights information contained elsewhere in this proxy statement and does not contain all of the information that you should consider before voting. For more complete information about the following topics, please review the complete proxy statement and the Annual Report onForm 10-K of Assured Guaranty Ltd. (which we refer to as AGL, we, us or our; we use Assured Guaranty, our Company or the Company to refer to AGL andtogether with its subsidiaries).

We intend to begin distribution of the Notice Regarding the Availability of Proxy Materials to shareholders on or about March 21, 2018.25, 2020.

ANNUAL GENERAL MEETING OF SHAREHOLDERS

| Time and Date | ||

| Place | 6 Bevis Marks London, EC3A 7BA United Kingdom | |

| Record Date | March | |

| Voting | Shareholders as of the record date are entitled to vote. Each Common Share is entitled to one vote for each director nominee and one vote for each of the proposals to be voted on. Shareholders of record may vote up until | |

Agenda Item | Board Vote Recommendation | Page Reference (for More Detail) | ||||||

Election of directors | For each director nominee | Page 12 | | |||||

Approval, on an advisory basis, of the compensation paid to AGL’s named executive officers | For | Page 67 | | |||||

Appointment of PricewaterhouseCoopers as AGL’s independent auditor for | For | Page 68 | | |||||

Direction of AGL to vote for directors of, and the appointment of the independent auditor of, AGL’s subsidiary, Assured Guaranty Re Ltd. | For each director nominee | Page 70 | |

We will also transact any other business that may properly come before the meeting.

At this writing, the novel Coronavirus responsible forCOVID-19 continues to spread and governments are taking various actions in response. If we postpone or change the time or location of our Annual General Meeting, we will issue a press release that we will make available on our website atwww.assuredguaranty.com/annualmeeting and file with the SEC as definitive additional proxy material. If you wish to receive a physical copy of any such press release, please contact our Secretary at generalcounsel@agltd.com or(441) 279-5725.

1

SUMMARY DIRECTOR INFORMATION

The following table provides summary information about each director nominee. Each director nominee will be elected for aone-year term by a majority of votes cast.

DIRECTOR SINCE | COMMITTEES | |||||||||||||||||||||||

| NOMINEE | AGE | PRINCIPAL OCCUPATION | A | C | F | NG | RO | E | ||||||||||||||||

| Francisco L. Borges | 66 | 2007 | Chairman, Landmark Partners, LLC | «

| «

| ||||||||||||||||||

| G. Lawrence Buhl | 71 | 2004 | Former Regional Director for Insurance Services, Ernst & Young LLP | «

| ✓

| ||||||||||||||||||

| Dominic J. Frederico | 65 | 2004 | President and Chief Executive Officer, Assured Guaranty Ltd. | ✓ | |||||||||||||||||||

| Bonnie L. Howard | 64 | 2012 | Former Chief Auditor and Global Head of Control and Emerging Risk, Citigroup | ✓

| «

| ||||||||||||||||||

| Thomas W. Jones | 68 | 2015 | Founder and Senior Partner of TWJ Capital, LLC | ✓ | ✓ | ||||||||||||||||||

| Patrick W. Kenny | 75 | 2004 | Former President and Chief Executive Officer, International Insurance Society | «

| ✓

| ✓

| |||||||||||||||||

| Alan J. Kreczko | 66 | 2015 | Former Executive Vice President and General Counsel of The Hartford Financial Services Group, Inc. | ✓ | ✓ | ||||||||||||||||||

| Simon W. Leathes | 70 | 2013 | Former independentnon-executive director of HSBC Bank plc | ✓ | ✓ | ✓ | |||||||||||||||||

| Michael T. O’Kane | 72 | 2005 | Former Senior Managing Director, Securities Division, TIAA CREF | ✓

| «

| ||||||||||||||||||

| Yukiko Omura | 62 | 2014 | Former Undersecretary General and Vice President/COO, International Fund for Agricultural Development | ✓ | ✓ | ||||||||||||||||||

| 2017 Meetings | 4 | 5 | 4 | 4 | 4 | 0 | ||||||||||||||||||

DIRECTOR |

COMMITTEES

| |||||||||||||||||||||||||

NOMINEE

| SINCE

| PRINCIPAL OCCUPATION

|

A

| C

| ES

| F

| NG

| RO

| E

| |||||||||||||||||

| Francisco L. Borges | 68 | 2007 | Chairman, Landmark Partners, LLC | ✓

| «

| «

| |||||||||||||||||||

| G. Lawrence Buhl | 73 | 2004 | Former Regional Director for Insurance Services, Ernst & Young LLP | «

| ✓

| ||||||||||||||||||||

| Dominic J. Frederico | 67 | 2004 | President and Chief Executive Officer, Assured Guaranty Ltd. | ✓ | |||||||||||||||||||||

| Bonnie L. Howard | 66 | 2012 | Former Chief Auditor and Global Head of Control and Emerging Risk, Citigroup | ✓

| «

| ||||||||||||||||||||

| Thomas W. Jones | 70 | 2015 | Founder and Senior Partner of TWJ Capital, LLC | ✓

| ✓

| ||||||||||||||||||||

| Patrick W. Kenny | 77 | 2004 | Former President and Chief Executive Officer, International Insurance Society | «

| ✓

| ✓

| ✓

| ||||||||||||||||||

| Alan J. Kreczko | 68 | 2015 | Former Executive Vice President and General Counsel of The Hartford Financial Services Group, Inc. | «

| ✓

| ✓

| |||||||||||||||||||

| Simon W. Leathes | 72 | 2013 | Former independentnon-executive director of HSBC Bank plc | ✓

| ✓

| ✓

| |||||||||||||||||||

| Michael T. O’Kane | 74 | 2005 | Former Senior Managing Director, Securities Division, TIAA CREF | ✓

| «

| ||||||||||||||||||||

| Yukiko Omura | 64 | 2014 | Former Undersecretary General and Vice President/COO, International Fund for Agricultural Development |

|

|

| ✓

|

| ✓

|

| |||||||||||||||

2019 Meetings | 4 | 5 | 2 1 | 4 | 4 | 4 | 0 | |||||||||||||||||||

| 1 | The Environmental and Social Responsibility Committee was establishedmid-year. |

A: Audit; C: Compensation; ES: Environmental and Social Responsibility; F: Finance; NG: Nominating and Governance; RO: Risk Oversight; E: Executive;Executive.

«: Chair;✓: Member

2

Our Board of Directors maintains strong corporate governance policies.

The Board and management have reviewed the rules of the Securities and Exchange Commission (which we refer to as the SEC)SEC and the New York Stock Exchange (which we refer to as the NYSE) listing standards regarding corporate governance policies and processes, and we are in compliance with the rules and listing standards.

We have adopted Corporate Governance Guidelines covering issues such as director qualification standards (including independence), director responsibilities, Board self-evaluations, and executive sessions of the Board.

Our Corporate Governance Guidelines contain our Categorical Standards for Director Independence.

We have adopted a Code of Conduct for our employees and directors and charters for each Board committee.

The full text of our Corporate Governance Guidelines, our Code of Conduct and each Board committee charter, are available on our website atwww.assuredguaranty.com/governance.governance. In addition, you may request copies of the Corporate Governance Guidelines, the Code of Conduct and the committee charters by contacting our Secretary via:

| Telephone | (441)279-5725 | |

| Facsimile | (441)279-5701 | |

| generalcounsel@agltd.com | ||

Our Board of Directors oversees our business and monitors the performance of management. The directors keep themselvesup-to-date on our Company by discussing matters with Mr. Frederico, who is our Chief Executive Officer (and whom we refer to as our CEO), other key executives and our principal external advisors, such as outside auditors, outside legal counsel, investment bankers and other consultants, by reading the reports and other materials that we send them regularly and by participating in Board and committee meetings.

The Board usually meets four times per year in regularly scheduled meetings, but will meet more often if necessary. During 2017,2019, the Board met fourfive times. All of our directors attended at least 75% of the aggregate number of meetings of the Board and committees of the Board of which they were a member held while they were in office during the year ended December 31, 2017.2019.

In February 2018,2020, our Board determined that, other than our CEO Mr. Frederico, all of our directors are independent under the listing standards of the NYSE. These independent directors constitute substantially more than a majority of our Board. In making its determination of independence, the Board applied its Categorical Standards for Director Independence and determined that no other material relationships existed between our Company and these directors. A copy of our Categorical Standards for Director Independence is available as part of our Corporate Governance Guidelines, which are available on our website atwww.assuredguaranty.com/governance.governance. In addition, as part of the independence determination, our Board monitors the independence of Audit and Compensation Committee members under rules of the SEC and NYSE listing standards that are applicable to members of the audit committee and compensation committees.committee.

As part of its independence determinations, the Board considered the other directorships held by the independent directors and determined that none of these directorships constituted a material relationship with our Company.

The independent directors meet at regularly scheduled executive sessions without the participation of management. The Chairman of the Board is the presiding director for executive sessions of independent directors.

OTHER CORPORATE GOVERNANCE HIGHLIGHTS

Our Board has a substantial majority of independent directors.

All members of the Audit, Compensation, Nominating and Governance, Finance, Environmental and Social Responsibility, and Risk Oversight Committees are independent directors.

3

Our Audit Committee recommends to the Board, which recommends to the shareholders, the annual appointment of our independent auditor. Each year our shareholders are asked to authorize the Board, acting through its Audit Committee, to determine the compensation of, and the scope of services performed by, our independent auditor. The Audit Committee also has the authority to retain outside advisors.

No member of our Audit Committee simultaneously serves on the audit committee of more than one other public company.

Our Compensation Committee has engaged a compensation consultant, Frederic W. Cook & Co., Inc., which we refer to as Cook, to assist it in evaluating the compensation of our CEO, based on corporate goals and objectives and, with the other independent directors, setting his compensation based on this evaluation. Cook has also assisted us in designing our executive compensation program. The Compensation Committee has conducted an assessment of Cook’s independence and has determined that Cook does not have any conflict of interest. Our Nominating and Governance Committee also engages Cook to assist it in evaluating the compensation of our Board of Directors.

We established an Executive Committee to exercise certain authority of the Board in the management of company affairs between regularly scheduled meetings of the Board when it is determined that a specified matter should not be postponed to the next scheduled meeting of the Board. Our Executive Committee did not meet in 2017.2019.

| • | We have adopted a Code of Conduct that sets forth basic principles to guide ourday-to-day activities. The Code of Conduct addresses, among other things, conflicts of interest, corporate opportunities, confidentiality, fair dealing, protection and proper use of company assets, compliance with laws and regulations, including insider trading laws, and reporting illegal or unethical behavior. The full text of our Code of Conduct is available on our website atwww.assuredguaranty.com/governance. |

In addition to AGL’s quarterly Board meetings, our Board has an annual business review meeting to assess specific areas of our Company’s operations and to learn about general trends affecting the financial guaranty industry.industry and asset management. We also provide our directors with the opportunity to attend continuing education programs.

We established an Environmental and Social Responsibility Committee in May 2019, and it began meeting in August 2019. Prior to the establishment of the Environmental and Social Responsibility Committee, our Nominating and Governance Committee was responsible for many such matters.

| • | We adopted an Environmental Policy and a Statement on Climate Change in February 2019 and, in February 2020, we adopted a Human Rights Statement. The current versions of these statements are available on our website at www.assuredguaranty.com/governance. |

In early 2020, we sought to engage with our shareholders with respect to environmental and social matters, which we refer to as E&S matters, and contacted holders of 31.9% of our outstanding Common Shares (which comprised every shareholder holding more than 5% of our outstanding Common Shares) and offered to discuss such matters. Holders of approximately 22% of our outstanding Common Shares provided us with specific feedback on E&S matters and our E&S disclosure.

In accordance with its charter, the Nominating and Governance Committee identifies potential nominees for directors from various sources. The Nominating and Governance Committee:

Reviews the qualifications of potential nominees to determine whether they might be good candidates for Board of Directors membership

Reviews the potential nominees’ judgment, experience, independence, understanding of our business or other related industries and such other factors as it determines are relevant in light of the needs of the Board of Directors and our Company

Selects qualified candidates and reviews its recommendations with the Board of Directors, which will decide whether to nominate the person for election to the Board of Directors at an Annual General Meeting of Shareholders (which we refer to as an Annual General Meeting). Between Annual General Meetings, the Board, upon the recommendation of the Nominating and Governance Committee, can fill vacancies on the Board by appointing a director to serve until the next Annual General MeetingMeeting.

The Nominating and Governance Committee has the authority to retain search firms to be used to identify director candidates and to approve the search firm’s fees and other retention terms. The Nominating and Governance Committee may also retain other advisors.

We believe that diversity among members of the Board is an important consideration and is critical to the Board’s ability to perform its duties and various roles. Accordingly, in recommending nominees, the Board considers a wide range of individual perspectives and backgrounds in addition to diversity in professional experience and training. Our Board is currently composed of individuals from different disciplines, including lawyers, accountants and individuals who have industry, finance, executive and international experience, and is composed of both men and women and citizens of the United States, the United Kingdom and Japan. Our Corporate Governance Guidelines address diversity of experience, requiring the Nominating and Governance Committee to review annually the

4

skills and attributes of Board members within the context of the currentmake-up of the full Board. Our Corporate Governance Guidelines also provide that Board members should have individual backgrounds that, when combined, provide a portfolio of experience and knowledge that will serve our governance and strategic needs. The Nominating and Governance Committee will consider Board candidates on the basis of a range of criteria, including broad-based business knowledge and contacts, prominence and sound reputation in their fields as well as having a global business perspective and commitment to good corporate citizenship. Our Corporate Governance Guidelines specify that directors should represent all shareholders and not any special interest group or constituency. The Nominating and Governance Committee annually reviews its own performance. In connection with such evaluation, the Nominating and Governance Committee assesses whether it effectively nominates candidates for director in accordance with the above described standards specified by the Corporate Governance Guidelines. See each nominee’s biography appearing later in this proxy statement for a description of the specific experience that each such individual brings to our Board.

Our Corporate Governance Guidelines additionally specify that directors should be able and prepared to provide wise and thoughtful counsel to top management on the full range of potential issues facing us. Directors must possess the highest personal and professional integrity. Directors must have the time necessary to fully meet their duty of due care to the shareholders and be willing to commit to service over the long term.

4

The Nominating and Governance Committee will consider a shareholder’s recommendation for director but has no obligation to recommend such candidatescandidate for nomination by the Board of Directors. Assuming that appropriate biographical and background material is provided for candidates recommended by shareholders, the Nominating and Governance Committee will evaluate those candidates by following substantially the same process and applying substantially the same criteria as for candidates recommended by other sources. If a shareholder has a suggestion for candidatesa candidate for election, the shareholder should send it to: Secretary, Assured Guaranty Ltd., 30 Woodbourne Avenue, Hamilton HM 08, Bermuda. No person recommended by a shareholder will become a nominee for director and be included in a proxy statement unless the Nominating and Governance Committee recommends, and the Board approves, such person.

If a shareholder desires to nominate a person for election as director at an Annual General Meeting, that shareholder must comply with Article 14 of AGL’sBye-Laws, which requires notice no later than 90 days prior to the anniversary date of the immediately preceding Annual General Meeting. This time period has passed with respect to the 20182020 Annual General Meeting. With respect to the 20192021 Annual General Meeting, AGL must receive such written notice on or prior to February 1, 2019.5, 2021. Such notice must describe the nomination in sufficient detail to be summarized on the agenda for the meeting and must set forth:

the shareholder’s name as it appears in AGL’s books

a representation that the shareholder is a record holder of AGL’s shares and intends to appear in person or by proxy at the meeting to present such proposal

the class and number of shares beneficially owned by the shareholder

the name and address of any person to be nominated

a description of all arrangements or understandings between the shareholder and each nominee and any other person or persons, naming such other person or persons, pursuant to which the nomination or nominations are to be made by the shareholder

such other information regarding each nominee proposed by such shareholder as would be required to be included in a proxy statement filed pursuant to the SEC’s proxy regulations

the consent of each nominee to serve as a director of AGL, if so elected

The Board of Directors has established an Audit Committee, a Compensation Committee, an Environmental and Social Responsibility Committee, a Finance Committee, a Nominating and Governance Committee, a Risk Oversight Committee and an Executive Committee. All of the Board committees other than the Executive Committee are composed entirely of directors who are independent of our Company and management, as defined by the NYSE listing standards and as applied by the Board.

| The Audit Committee | Chairman: G. Lawrence Buhl / 4 meetings during | |

Other Audit Committee members: Bonnie L. Howard, Thomas W. Jones, | ||

The Audit Committee provides oversight of the integrity of our Company’s financial statements and financial reporting process, our compliance with legal and regulatory requirements (including cybersecurity requirements), the system of internal controls, the audit process, the performance of our internal audit program and the performance, qualification and independence of the independent

5

auditor. The Audit Committee is also responsible for the oversight of Company risks related to (i) financial reporting, accounting policies and reserving, (ii) legal, regulatory and compliance matters, (iii) information technology (including cybersecurity), (iv) workouts, emerging events, and counterparties, (v) outsourcing and people, and (vi) business continuity planning.

The Audit Committee is composed entirely of directors who are independent of our Company and management, as defined by the NYSE listing standards.standards and as applied by the Board.

The Board has determined that each member of the Audit Committee satisfies the financial literacy requirements of the NYSE and except for Mr. Kreczko, is an audit committee financial expert, as that term is defined under Item 407(d) of the SEC’sRegulation S-K. For additional information about the qualifications of the Audit Committee members, see their respective biographies set forth in “Proposal No. 1: Election of Directors.”

| The Compensation Committee | Chairman: Patrick W. Kenny / | |

Other Compensation Committee members: G. Lawrence Buhl, Jones | ||

The Compensation Committee has responsibility for evaluating the performance of our CEO and senior management and determining executive compensation in conjunction with the independent directors. The Compensation Committee also works with the Nominating and Governance Committee and our CEO on succession planning. The Compensation Committee is also responsible for the oversight of Company risks related to people, succession planning and compensation.

The Compensation Committee is composed entirely of directors who are independent of our Company and management, as defined by the NYSE listing standards.standards and as applied by the Board.

The Compensation Committee’s meetings included discussions with Cook to review executive compensation trends and peercomparison group compensation data and to evaluate the risk of our executive compensation program.

5

| Environmental and Social Responsibility Committee | Chairman: Alan J. Kreczko / 2 meetings during 2019 | |

Other Environmental and Social Responsibility Committee members: Francisco L. Borges and Patrick J. Kenny | ||

The Environmental and Social Responsibility Committee provides oversight and review of the Company’s significant strategies, policies and practices regarding environmental and social responsibilities. The Environmental and Social Responsibility Committee focuses on four principal subject areas: (i) environmental stewardship, including risks and opportunities posed by environmental issues; (ii) corporate social responsibility, including community engagement and corporate philanthropy; (iii) workforce equality and wellness, including diversity and inclusion; and (iv) stakeholder engagement. The Environmental and Social Committee was established after the May 2019 Board meeting and met in both of the succeeding quarters, in August and November 2019. Prior to the establishment of the Environmental and Social Responsibility Committee, the Nominating and Governance Committee was responsible for many such matters.

| The Finance Committee | Chairman: Michael T. O’Kane / 4 meetings during | |

Other Finance Committee members: | ||

The Finance Committee of the Board of Directors oversees management’s investment of our Company’s investment portfolio, including in alternative investments.investments, and is responsible for oversight of Company risks related to capital, liquidity, investments, financial market conditions, foreign currency, and rating agencies. The Finance Committee also oversees, and makes recommendations to the Board with respect to, our capital structure, dividends, financing arrangements, investment guidelines, potential alternative investments and any corporate development activities.

| The Nominating and Governance Committee | Chairman: Francisco Borges / 4 meetings during | |

Other Nominating and Governance Committee members: | ||

The responsibilities of the Nominating and Governance Committee include identifying individuals qualified to become Board members, recommending director nominees to the Board and developing and recommending corporate governance guidelines.guidelines, as well as the oversight of Company risks related to board qualification, corporate structure, governance, regulatory compliance and people. The Nominating and Governance Committee also has responsibility to review and make recommendations to the full Board regarding director compensation. In addition to general corporate governance matters, the Nominating and Governance Committee assists the Board and the Board committees in their self-evaluations. The Nominating and Governance Committee is composed entirely of directors who are independent of our Company and management, as defined by the NYSE listing standards.standards and as applied by the Board.

6

| The Risk Oversight Committee | Chairman: Bonnie L. Howard / 4 meetings during | |

Other Risk Oversight Committee members: Simon W. Leathes, Yukiko Omura | ||

The Risk Oversight Committee oversees management’s establishment and implementation of standards, controls, limits, guidelines and policies relating to risk appetite, risk assessment and enterprise risk management. The Risk Oversight Committee focuses on both the underwriting, surveillance and surveillanceworkout of credit risks andas well as the assessment, management and managementoversight of other Company enterprise risks, including, but not limited to, financial, legal, operational (including cybersecurity)information technology, cybersecurity and vendor management) and other risks concerning our Company’s governance, reputation and ethical standards.

| The Executive Committee | Chairman: Francisco L. Borges / | |

Other Executive Committee members: Dominic J. Frederico, Patrick W. Kenny, Simon W. Leathes | ||

The Executive Committee was established to have, and to exercise, certain of the powers and authority of the Board in the management of the business and affairs of our Company between regularly scheduled meetings of the Board when, in the opinion of a quorum of the Executive Committee, a matter should not be postponed to the next scheduled meeting of the Board. The Executive Committee’s authority to act is limited by our Company’sBye-Laws, rules of the NYSE and applicable law and regulation and the Committee’s charter.

HOW ARE DIRECTORS COMPENSATED?

In 2017, our Nominating and Governance Committee engaged Cook to conduct a comprehensive review and assessment of our independent director compensation program. Cook reviews this program periodically. Cook evaluated the director compensation by comparing it against the compensation awarded to directors of companies in our executive compensation comparison group. (The compensation comparison group is discussed below under “Compensation Discussion and Analysis–Compensation Governance–Executive Compensation Comparison Group”.) Cook also looked at a broader market segment using data from Cook’s report regarding compensation packages for public companyOur independent directors for 2016, the most recent year for which information was available. Cook again found that the structure of our director compensation program was generally consistent with peer group policies and best practice design as recognized by the proxy advisory firms and investors, noting:

6

Cook found that the percentage of our independent director compensation paid in equity was below the median of the comparison group practice of 61%, while the retainer for thenon-executive Chairman was at the 25th percentile of the comparison group practice. Cook recommended that thenon-executive Chairman retainer should be reviewed for reasonableness and appropriateness in light of the strategic importance of the position to our Company, the skill set and experience of the Chairman, and the expected time commitment.

After considering Cook’s market data, analysis and recommendations, the Nominating and Governance Committee made two changes to the independent director compensation in light of the expanding scope of the Company’s business as well as the time commitment associated with attending Board meetings in the U.K. The Nominating and Governance Committee increased the equity portion of thereceive an annual retainer of our independent directors by $25,000.$265,000 per year. We now pay $145,000 of the retainer in restricted stock and $120,000 of the retainer in cash, for a total annual retainer of $265,000. The Nominating and Governance Committee also increased the annual retainer paid to thenon-executive Chairman, which had not been increased for several years and, as a result, was at the 25th percentile of the peer group practice. In 2017, the Chairman’s annual retainer was increased from $125,000 to $225,000.cash. A director also may elect to receive any or all of the cash portion of his or her entire annual retainer (plus the additional cash amounts described below) in restricted stock.

The restricted stock vests on the day immediately prior to the next Annual General Meeting following the grant of the stock. However, if, prior to such vesting date, either (i) a change in control (as defined in the Assured Guaranty Ltd. 2004 Long-Term Incentive Plan, as amended) of Assured Guaranty Ltd. occurs before the director terminates service on the Board or (ii) the director terminates service on the Board as a result of such director’s death or disability, then the restricted stock will vest on the date of such change in control or the date of the director’s termination of service, whichever is applicable. Grants of restricted stock receive cash dividends and have voting rights; the cash dividends accrue during the vesting period and are paid upon vesting.

In addition to the annual retainers described above:

The Company generally will not pay a fee for attendance at Board or committee meetings, although the Chairman of the Board has the discretion to pay attendance fees of $2,000 for extraordinary or special meetings. There were no extraordinary or special meetings of the Board in 2017. We do not pay a fee for being a member, or attending meetings, of the Executive Committee.

In addition to the annual retainers paid to independent directors, Cook also reviewed the director stock ownership requirements. Cook noted that because the director stock ownership guidelines are expressed as the greater of 25,000 shares or a multiple of the cash portion of thenon-employee director retainer, the dollar value of the ownership requirement fluctuates based on changes in our Company’s stock price until the ownership guideline is met. Cook found that the ownership requirement expressed as a multiple of the cash retainer and as a dollar value is above the 75th percentile of the peer group practice, and above the ISS best practice of five times the current annual cash retainer. Cook suggested the Nominating and Governance Committee consider moving to a guideline of five times the current annual cash retainer with no minimum share ownership requirement. The Nominating and Governance Committee considered Cook’s suggestion and increased the share ownership guidelines to five times the current cash annual retainer to be consistent with best practices but did not eliminate the 25,000 share ownership component since doing so would reduce the share ownership guideline.

As recently revised, ourOur share ownership guidelines require that, each independent director own the greater of (i) at least 25,000 Common Shares or (ii) Common Shares with a market value of at least five times the maximum cash portion of the annual director retainer, before being permitted to dispose of any shares acquired as compensation from our Company.Company, each independent director own Common Shares with a market value of at least $600,000, which amount is five times the maximum cash portion of the annual director retainer (exclusive of committee fees). (Prior to May 2019 the minimum was the greater of that amount or 25,000 shares.) Once a director has reached the share ownership guideline, for so long as he or she serves on the Board, such director may not dispose of any Common Shares if such disposition would cause the director to be below the share ownership guideline. Common Shares that had been restricted but subsequently vested and purchased Common Shares count toward the share ownership guideline. Our four longest servingSeven independent directors meet our share ownership guidelines. Our five newer Board members (Ms. Howard, who joined the Board in August 2012; Mr.Two independent directors (Mr. Leathes, who joined the Board in May 2013;2013 and Ms. Omura, who joined the Board in May 2014; and Messrs. Jones and Kreczko, who joined the Board in August 2015)2014) are accumulating Common Shares toward their ownership goals.

In addition to the annual retainer described above:

Thenon-executive Chairman of the Board receives an annual retainer of $225,000 in recognition of the strategic role he plays and the time commitment involved. The Chairman of the Board has elected not to receive any fees for serving as a member or chair of a board committee.

The Chairman of each committee of the Board other than the Executive Committee receives an additional $30,000 annual retainer.

Members, other than the chairman of the committee, of each committee of the Board other than the Executive Committee receive an additional $15,000 annual retainer.

The Company generally will not pay a fee for attendance at Board or committee meetings, although the Chairman of the Board has the discretion to pay attendance fees of $2,000 for extraordinary or special meetings. There was one extraordinary meeting of the Board in 2019 (to consider our acquisition of BlueMountain), but no attendance fee was paid for attendance at that meeting. We do not pay a fee for being a member, or attending meetings, of the Executive Committee.

In 2019, our Nominating and Governance Committee engaged Cook to conduct a comprehensive review and assessment of our independent director compensation program. Cook reviews this program periodically. Cook evaluated our director compensation by comparing it against the compensation awarded to directors of companies in our executive compensation comparison group as

7

constituted before the addition of the four new companies as described under “Compensation Discussion and Analysis—Compensation Governance—Executive Compensation Comparison Group” on page 48 below, and which we refer to as the prior executive compensation comparison group. Cook also looked at a broader market segment using data from Cook’s report for compensation packages for public company independent directors for 2018, the most recent year for which such information was available. Cook found that the structure of our director compensation program was generally consistent with prior executive compensation comparison group policy and best practice design as recognized by the proxy advisory firms and investors, noting:

the absence of meeting fees to simplify program administration and avoid the implication that there is additional pay for meeting attendance, which is an expected part of Board service

the use of committee member retainers to differentiate compensation among directors based on workload

the vesting of annual restricted stock awards over aone-year period, which protects against the possibility of director entrenchment

the payment of additional retainers to the board and committee leadership to recognize the additional responsibilities and time commitment associated with these roles

our limited benefits (we provide a Company match of up to $15,000 per director for contributions to charitable organizations of the director’s choice)

a meaningful and robust stock ownership guideline

No changes were made to our independent director compensation program in 2019, although the director share ownership guideline was simplified pursuant to a recommendation from Cook. Cook observed that, with the increase of our stock price over the years, that portion of our independent stock ownership guideline requiring ownership of 25,000 common shares had the effect of increasing materially the dollar value of the requirement and was volatile, while the other portion of our guideline requiring ownership of common shares with a market value of at least five times the maximum cash portion of the annual director retainer was itself higher than the 75th percentile of prior executive compensation comparison group practice and consistent with the best practice identified by a major proxy advisory firm. Consequently, Cook recommended amending the guideline to remove the 25,000 common share floor, and we did so.

Cook found that the aggregate cost of our independent director compensation program approximates the 75th percentile of our prior executive compensation comparison group. Cook also found that, before considering the instances where our directors have chosen to receive a portion of their cash compensation in our common shares, our total per director compensation has a somewhat heavier weighting on cash compensation than that of our prior executive compensation comparison group.

DIRECTOR COMPENSATION

The following table sets forth our 20172019 independent director compensation, including the compensation for the directors’ committee assignments as of such date.

| Name | Fees Earned or Paid in Cash | Stock Awards(1) | All Other Compensation(2) | Total | Fees Earned or Paid in Cash | Stock Awards(1) | All Other Compensation(2) | Total | ||||||||||||||||||||||||

Francisco L. Borges(3)

|

|

$345,000

|

|

|

$145,000

|

|

|

$16,059

|

|

$

|

506,059

|

|

| $345,000 |

|

| $145,000 |

|

| $33,014 |

| $ | 523,014 |

| ||||||||

G. Lawrence Buhl

|

|

$165,000

|

|

|

$145,000

|

|

|

$26,382

|

|

$

|

336,382

|

|

| $165,000 |

|

| $145,000 |

|

| $30,883 |

| $ | 340,883 |

| ||||||||

Bonnie L. Howard

|

|

$165,000

|

|

|

$145,000

|

|

|

$16,118

|

|

$

|

326,118

|

|

| $165,000 |

|

| $145,000 |

|

| $21,503 |

| $ | 331,503 |

| ||||||||

Thomas W. Jones

|

|

$150,000

|

|

|

$145,000

|

|

|

$31,570

|

|

$

|

326,570

|

|

| $150,000 |

|

| $145,000 |

|

| $25,665 |

| $ | 320,665 |

| ||||||||

Patrick W. Kenny(4)

|

|

$165,000

|

|

|

$145,000

|

|

|

$23,838

|

|

$

|

333,838

|

|

| $180,000 |

|

| $145,000 |

|

| $29,747 |

| $ | 354,747 |

| ||||||||

Alan J. Kreczko(5)

|

|

$150,000

|

|

|

$145,000

|

|

|

$23,835

|

|

$

|

318,835

|

|

| $180,000 |

|

| $145,000 |

|

| $27,143 |

| $ | 352,143 |

| ||||||||

Simon W. Leathes(6)

|

|

$239,457

|

|

|

$145,000

|

|

|

$675

|

|

$

|

385,132

|

|

| $272,725 |

|

| $145,000 |

|

| $ 929 |

| $ | 418,654 |

| ||||||||

Michael T. O’Kane

|

|

$165,000

|

|

|

$145,000

|

|

|

$8,806

|

|

$

|

318,806

|

|

| $165,000 |

|

| $145,000 |

|

| $12,654 |

| $ | 322,654 |

| ||||||||

Yukiko Omura

|

|

$150,000

|

|

|

$145,000

|

|

|

—

|

|

$

|

295,000

|

|

| $150,000 |

|

| $145,000 |

|

| — |

| $ | 295,000 |

| ||||||||

| (1) | Represents grant date fair value, rounded to the nearest $1,000. |

| (2) | Other compensation consists of matching gift donations to eligible charities paid in |

| (3) | Mr. Borges agreed to forgo an additional fee as the Chairman of the Nominating and Governance Committee due to the substantial overlap between that position and his position as the Chairman of the |

8

| (4) | Mr. Kenny elected to receive |

| (5) | Mr. Kreczko elected to receive the entire cash component of his compensation as restricted stock. |

| (6) | The fees for Mr. Leathes include |

The following table shows information related to independent director equity awards outstanding on December 31, 2017:2019:

| Name | Unvested Restricted Stock(1) | Vested Stock Options | Unvested Restricted Stock(1) | Vested Stock Options | ||||||||||||

Francisco L. Borges

|

|

12,919

|

|

|

7,658

|

| 10,657 | 7,658 | ||||||||

G. Lawrence Buhl

|

|

3,823

|

|

|

7,026

|

| 3,154 | 3,153 | ||||||||

Bonnie L. Howard

|

|

3,823

|

|

|

—

|

| 3,154 | — | ||||||||

Thomas W. Jones

|

|

3,823

|

|

|

—

|

| 3,154 | — | ||||||||

Patrick W. Kenny

|

|

6,591

|

|

|

13,561

|

| 3,806 | 4,955 | ||||||||

Alan J. Kreczko

|

|

7,777

|

|

|

—

|

| 7,068 | — | ||||||||

Simon W. Leathes

|

|

3,823

|

|

|

—

|

| 3,154 | — | ||||||||

Michael T. O’Kane

|

|

3,823

|

|

|

7,026

|

| 3,154 | 3,153 | ||||||||

Yukiko Omura

|

|

3,823

|

|

|

—

|

| 3,154 | — | ||||||||

| (1) | Vests one day prior to the |

WHAT IS OUR BOARD LEADERSHIP STRUCTURE?

Our current Chairman of the Board is Francisco L. Borges. The position of CEO is held by Dominic Frederico.

While the Board has no fixed policy with respect to combining or separating the offices of Chairman of the Board and CEO, those two positions have been held by separate individuals since our 2004 initial public offering. We believe this is the appropriate leadership

8

structure for us at this time. Mr. Borges and Mr. Frederico have had an excellent working relationship, which has continued to permit Mr. Frederico to focus on running our business and Mr. Borges to focus on Board matters, including oversight of our management. Mr. Borges and Mr. Frederico collaborate on setting agendas for Board meetings to be sure that the Board discusses the topics necessary for its oversight of the management and affairs of our Company. As Chairman of the Board, Mr. Borges sets the final Board agenda and chairs Board meetings, including executive sessions at which neither our CEO nor any other member of management is present. The Chairman of the Board also chairs our Annual General Meetings.

HOW DOES THE BOARD OVERSEE RISK?

The Board’s role in risk oversight is consistent with our leadership structure, with our CEO and other members of senior management having responsibility for assessing and managing risk exposure and the Board and its committees providing oversight in connection with these activities. Our Company’s policies and procedures relating to risk assessment and risk management are overseen by our Board. The Board takes an enterprise-wide approach to risk management that is designed to support our business plans at a reasonable level of risk. A fundamental part of risk assessment and risk management is not only understanding the risks a company faces and what steps management is taking to manage those risks, but also understanding what level of risk is appropriate for us. The Board annually approves our business plan, factoring risk management into account. The involvement of the Board in setting our business strategy is a key part of its assessment of management’s risk tolerance and also a determination of what constitutes an appropriate level of risk for us.

While the Board of Directors has the ultimate oversight responsibility for the risk management process, various committees of the Board also have responsibility for risk assessment and risk management. As discussed under “Committees of the Board,” the Board has created a Risk Oversight Committee that oversees the standards, controls, limits, guidelines and policies that our Company establishes and implements in respect of credit underwriting and risk management. It focuses on management’s assessment and management of both (i) credit risks and (ii) other enterprise risks, including, but not limited to, financial, legal and operational risks (including cybersecurity risks), and risks relating to our reputation and ethical standards. Our Risk Oversight Committee and Board pay particular attention to credit risks we assume when we issue financial guaranties or engage in strategic transactions.transactions and to risks related to Assured Investment Management. In addition, the Audit Committee of the Board of Directors is responsible for reviewing policies and

9

processes related to the evaluation of risk assessment and risk management, including our major financial risk exposures and the steps management has taken to monitor and control such exposures. It also oversees cybersecurity risks and reviews compliance with legal and regulatory requirements. The Finance Committee of the Board of Directors oversees the investment of the Company’s investment portfolio (including alternative investments) and the Company’s capital structure, financing arrangements and any corporate development activities in support of the Company’s financial plan. The Nominating and Governance Committee of the Board of Directors oversees risk at the Company by developing appropriate corporate governance guidelines and identifying qualified individuals to become board members. The Environmental and Social Responsibility Committee oversees risks related to the environment, sustainability and social responsibility, while each of the other Board committees have responsibility for risk assessment of such risks to the extent within their purview.

As part of its oversight of executive compensation, the Compensation Committee reviews compensation risk. The Compensation Committee oversaw the performance of a risk assessment of our employee compensation program to determine whether any of the risks arising from our compensation program are reasonably likely to have a material adverse effect on us. Since January 2011, the Compensation Committee has retained Cook to perform an annual review of each of our compensation plans and identify areas of risk and the extent of such risk. The Compensation Committee directs that our Chief Risk Officer work with Cook to perform such risk assessment and to be sure that compensation risk is included in our enterprise risk management system. In conducting this assessment, fromtime-to-time, most recently in February 2019, Cook performs a comprehensive systemic, qualitative review of all of our incentive compensation programs and reviews its findings with our Chief Risk Officer for completeness and accuracy. Cook seeks to identify any general areas of risk or potential for unintended consequences that exist in the design of our compensation programs and to evaluate our incentive plans relative to our enterprise risks to identify potential areas of concern, if any.

Cook undertook a compensation risk assessment update most recently in February 20182020 and concluded that our incentive plans, including the changes we made for 2020, are well-aligned with sound compensation design principles and do not encourage behaviors that would create material risk for our Company. Our Chief Risk Officer reviewed their findings and agreed with their conclusion. Based on this update, the Compensation Committee continued to find that there is an appropriate balance between the risks inherent in our business and our compensation program.

COMPENSATION COMMITTEE INTERLOCKING AND INSIDER PARTICIPATION

The Compensation Committee of our Board of Directors has responsibility for determining the compensation of our executive officers. None of the members of the Compensation Committee is a current or former officer or employee of our Company. No executive officer of our Company serves on the compensation committee of any company that employs any member of the Compensation Committee.

WHAT IS OUR RELATED PERSON TRANSACTIONS APPROVAL POLICY AND WHAT PROCEDURES DO WE USE TO IMPLEMENT IT?

Through our committee charters, we have established review and approval policies for transactions involving our Company and related persons, with the Nominating and Governance Committee taking the primary approval responsibility for transactions with our executive officers and directors and the Audit Committee taking the primary approval responsibility for transactions with 5% shareholders. No member of these committees who has an interest in a transaction being reviewed is allowed to participate in any decision regarding any such transaction.

9

Our Nominating and Governance Committee charter requires the Nominating and Governance Committee to review and approve or disapprove all proposed transactions with executive officers and directors that, if entered into, would be required to be disclosed pursuant to Item 404 ofRegulation S-K, the SEC provision which requires disclosure of any related person transaction with our Company that exceeds $120,000 per fiscal year. The Nominating and Governance Committee must also review reports, which our General Counsel provides periodically, and not less often than annually, regarding transactions with executive officers and directors (other than compensation) that have resulted, or could result, in expenditures thateven if they are not required to be disclosed pursuant to Item 404 ofRegulation S-K.

Our Audit Committee charter requires our Audit Committee to review and approve or disapprove all proposed transactions with any person owning more than 5% of any class of our voting securities that, if entered into, would be required to be disclosed pursuant to Item 404 ofRegulation S-K. In addition, our Audit Committee charter requires the Audit Committee to review reports regarding such transactions, which our General Counsel provides to the Audit Committee periodically, and not less often than annually, regarding transactions with any persons owning more than 5% of any class of the voting securities of AGL that have resulted, or could result, in expenditures thateven if they are not required to be disclosed pursuant to Item 404 ofRegulation S-K. Our Audit Committee charter also requires the Audit Committee to review other reports and disclosures of insider and affiliated party transactions which our General Counsel provides periodically, and not less often than annually.

10

Our General Counsel identifies related partyperson transactions requiring committee review pursuant to our committee charters from transactions that are:

disclosed in director and officer questionnaires (which must also be completed by nominees for director) or in certifications of Code of Conduct compliance

reported directly by the related person or by another employee of our Company

identified by our Chief Financial Officervendor management procedures based on comparison of vendors against a list of directors, executive officers and known 5% shareholders and certain of their related persons

If we have a related person transaction that requires committee approval in accordance with the policies set forth in our committee charters, we either seek that approval before we enter into the transaction or, if that timing is not practical, we ask the appropriate committee to ratify the transaction.

WHAT RELATED PERSON TRANSACTIONS DO WE HAVE?

From time to time, institutional investors, such as large investment management firms, mutual fund management organizations and other financial organizations become beneficial owners (through aggregation of holdings of their affiliates) of 5% or more of a class of our voting securities and, as a result, are considered “related persons” under the SEC’s rules. These organizations may provide services to us. In 2017,2019, the following transactions occurred with investors who reported beneficial ownership of 5% or more of our voting securities.

As indicated in “Which Shareholders Own More Than 5% of Our Common Shares,” Wellington Management Group LLP, which we refer to as Wellington Management, and BlackRock, Inc., which we refer to as BlackRock, own approximately 8.25%8.48% and 5.18%5.67% of AGL’s Common Shares outstanding, respectively, as of March 8, 2018,13, 2020 (the record date for our Annual General Meeting), based on the amount of Common Shares they reported in their Schedule 13G filings.filings as of the date set forth in such filing, and on the amount of Common Shares outstanding as of the record date. We appointed both Wellington Management and BlackRock as investment managers to manage certain of our investment accounts prior to their reaching such ownership thresholds. As of December 31, 2017,2019, Wellington Management managed approximately $2.3$1.95 billion of our investment assets, which is approximately 20%19% of our total fixed maturity and short-term investment portfolio, and BlackRock managed approximately $2.4$2.2 billion of our investment assets, which is approximately 21%22% of our total fixed maturity and short-term investment portfolio. In 2017,2019, we incurred expenses of approximately $1.8$1.7 million related to our investment management agreement with Wellington Management and $2.3$1.9 million with respect to our investment management and investment reporting agreements with BlackRock.

In addition, as previously disclosed, we repurchased 297,131 common shares fromFrom time to time, certain officers, directors, employees, their family members and related charitable foundations may make investments in various private funds, vehicles or accounts managed by our CEO and 23,062 common shares from our then General Counsel on January 6, 2017 at a per share price equalCompany. These investments are available to $38.73, the closing price of onethose of our Common Shares onCompany’s employees whom we have determined to have a status that reasonably permits us to offer them these types of investments in compliance with applicable laws. Generally, these investments are not subject to the New York Stock Exchange on such date, withmanagement fees and performance allocations or incentive fees charged to other investors. Andrew Feldstein, our CEO receiving aggregate proceedsChief Investment Officer and Head of $11,507,883.63 andAsset Management, is among our then General Counsel receiving aggregate proceeds of $893,191.26 from such repurchases. Our CEO and then General Counsel also separately received 297,131 and 23,062 Common Shares, respectively, on January 6, 2017employees who invest in settlement of 297,131 share units and 23,062 share units which such officers held in the employer stock fund of the Assured Guaranty Ltd. Supplemental Employee Retirement Plan that were required to be distributed in January 2017 to comply with requirements of Sections 409A and 457A of the Internal Revenue Code of 1986, as amended.various private funds, vehicles or accounts managed by our Company.

DID OUR INSIDERS COMPLY WITHDELINQUENT SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING IN 2017?REPORTS

Our executive officers and directors are subject to the reporting requirements of Section 16 of the Securities Exchange Act of 1934, as amended, which we refer to as the Exchange Act. We believe that all of our executive officers and directors complied with all filing requirements imposed by Section 16(a) of the Exchange Act on a timely basis during fiscal year 2017.2019.

1011

PROPOSAL NO. 1:ELECTION OF DIRECTORS

GENERAL

OurBye-Laws provide for a maximum of 21 directors and empower our Board of Directors to fix the exact number of directors and appoint persons to fill any vacancies on the Board until the next Annual General Meeting. The Board may appoint any person as a director to fill a vacancy on the Board occurring as the result of any existing director being removed from office pursuant to theBye-Laws or prohibited from being director by law; being or becoming bankrupt or making any arrangement or composition with his or her creditors generally; being or becoming disqualified, of unsound mind, or dying; or resigning. The Board may also appoint a person as a director to fill a vacancy resulting from an increase in the size of the Board or a vacancy left unfilled at an Annual General Meeting.

Our Board currently consists of 10 members. Following the recommendation of the Nominating and Governance Committee, our Board of Directors has nominated Francisco L. Borges, G. Lawrence Buhl, Dominic J. Frederico, Bonnie L. Howard, Thomas W. Jones, Patrick W. Kenny, Alan J. Kreczko, Simon W. Leathes, Michael T. O’Kane and Yukiko Omura as directors of AGL. Proposal No. 1 is Item 1 on the proxy card.

Our directors are elected annually to serve until their respective successors shall have been elected.

| The board of directors recommends that you vote “FOR” the election of the nominees as directors of AGL. |

It is the intention of the persons named as proxies, subject to any direction to the contrary, to vote in favor of the candidates nominated by the Board of Directors. We know of no reason why any nominee may be unable to serve as a director. If any nominee is unable to serve, your proxy may vote for another nominee proposed by the Board, or the Board may reduce the number of directors to be elected.

We have set forth below information with respect to the nominees for election as directors. There are no arrangements or understandings between any director and any other person pursuant to which any director was or is selected as a director or nominee.

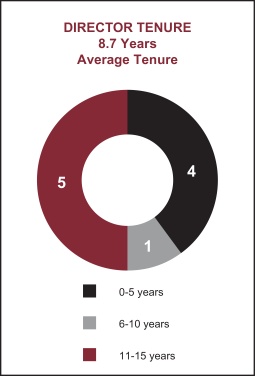

DIRECTOR TENURE 8.7 YEARS Average Tenure 5 4 1 0-5 years 6-10 years 11-15 years

1112

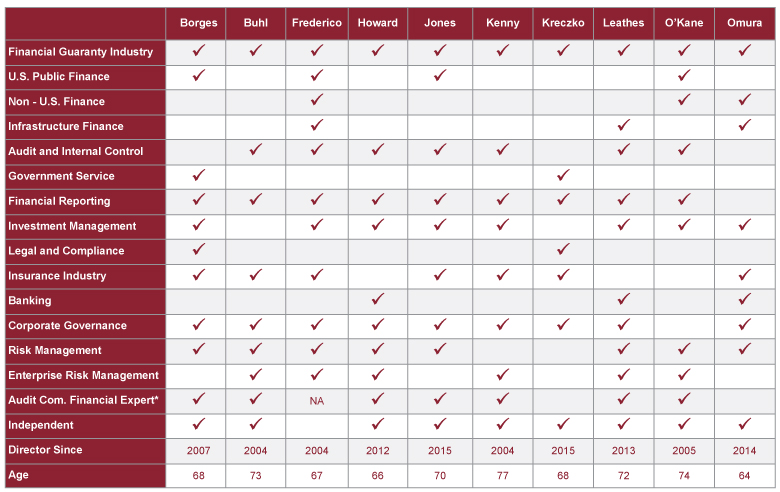

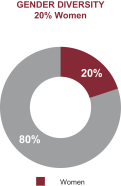

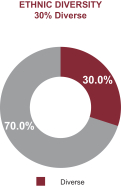

Summary information about our director nominees and overall composition of our Board is provided in the matrix and graphs below. Further information about each director nominee may be found on the following pages.

|  |  |  |

| * | In the case of persons who are not currently serving on the Audit Committee, the individual is likely to be qualified to be an audit committee financial expert based on their experience, but was not designated as such by the Board of Directors this year. |

13

NOMINEES FOR DIRECTOR

Francisco L. Borges

Chairman of the Board

Director Since:2007

Committee Memberships:

Nominating and Governance (Chair)

Executive (Chair) Environmental and Social Responsibility |   |

Qualifications:

Mr. Borges has expertise in finance arising from his experience structuring and marketing financial guaranty insurance.insurance, and in investment management. In addition, his public service background has given him insight on public finance. His current position gives Mr. Borges insights into the financial markets in which our Company operates.operates and will be particularly useful as our Company expands its asset management business. Each of these areas is important to our business.

Biography:

Mr. Borges, age 66,68, became a director of AGL in August 2007, and has been Chairman of our Board of Directors since May 2015. He is Chairman of Landmark Partners, LLC, an alternative investment management firm where he has been employed since 1999. Prior to joining Landmark, Mr. Borges was managing director of GE Capital’s Financial Guaranty Insurance Company and capital markets subsidiaries. Mr. Borges is a former Treasurer for the State of Connecticut and a former Deputy Mayor of the City of Hartford, Connecticut.

Mr. Borges serves onalso chairs the board of directors for Connecticut Public Broadcasting Network,trustees of the Knight Foundation and is a member of the board of trustees for the Millbrook School. He is also a member of the board of directors of Davis Selected Funds, where he serves on the Pricing Committee, and Leucadia National Corporation,Jefferies Financial Group Inc., where he serves on the Audit Committee and the Nominating and Corporate Governance Committee.

G. Lawrence Buhl

Independent Director

Director Since:2004

Committee Memberships:

Audit (Chair)

Compensation |   |

Qualifications:

Mr. Buhl’s insurance and Board experience and his knowledge of specific financial reporting requirements applicable to financial guaranty companies and familiarity with compliance, finance, governance, control environment and risk management requirements and processes for public companies and the financial guaranty industry benefit the Board in its deliberations and oversight.

Biography:

Mr. Buhl, age 71,73, became a director of AGL upon completion of our 2004 initial public offering. Through 2003, Mr. Buhl served as the Regional Director for Insurance Services in Ernst & Young LLP’s Philadelphia, New York and Baltimore offices and as audit engagement partner for insurance companies, including those in the financial guaranty industry.

Mr. Buhl began in 2004 to serveserved as a director for Harleysville Group, Inc. (NASDAQ: HGIC) and its majority shareholder, Harleysville Mutual Insurance Company, from 2004 through their 2012 merger/combination with Nationwide Mutual Insurance Company and served on an Advisory Board to Nationwide through April 2014. Mr. Buhl has beenis a member of the Board of Directors of Penn National Insurance Group in Harrisburg, PAPa. since April 2015 and is also an emeritus member of the Board of Sponsors of the Sellinger School of Business and Management of Loyola University Maryland.

1214

Dominic J. Frederico

Chief Executive Officer

Director Since:2004

Committee Memberships:

Executive |   |

Qualifications:

Mr. Frederico has the most comprehensive knowledge of all aspects of our operations as well as executive experience. He also has extensive industry experience, which makes him valuable both as an officer and as a director of AGL.

Biography:

Mr. Frederico, age 65,67, has been a director of AGL since our 2004 initial public offering, and the President and Chief Executive Officer of AGL since 2003. During his tenure as President and Chief Executive Officer, our Company became the leading provider of municipal bond insurance and financial guaranties. Under his leadership, our Company completed its 2004 initial public offering and, in 2009, acquired the financial guaranty insurance company now named Assured Guaranty Municipal Corp., thereby bringing together the only two monoline bond insurers to continue writing financial guaranty policies before, during and after the 2008 financial crisis.

Mr. Frederico served as Vice Chairman of ACE Limited (now known as Chubb Limited) from 2003 until 2004 and served as President and Chief Operating Officer of ACE Limited and Chairman of ACE INA Holdings, Inc. from 1999 to 2003. Mr. Frederico was a director of ACE Limited from 2001 through May 2005. From 1995 to 1999, Mr. Frederico served in a number of executive positions with ACE Limited. Limited, during which period he oversaw the successful acquisition and integration of the domestic and international property casualty operations acquired by ACE Limited from CIGNA Corporation in July 1999 and the acquisition of Capital Re Corp., the predecessor company to our Company, in December 1999.

Prior to joining ACE Limited, Mr. Frederico spent 13 years working for various subsidiaries of the American International Group.

His last position at the group was Senior Vice President and Chief Financial Officer of AIG Risk Management.

Bonnie L. Howard

Independent Director

Director Since:2012

Committee Memberships:

Risk Oversight (Chair)

|   |

Qualifications:

Ms. Howard’s background in audit, finance and enterprise risk management is valuable to the Board in its oversight of our financial reporting and credit and risk management policies.

Biography:

Ms.Bonnie L. Howard, age 64,66, became a director of AGL in August 2012. Ms. Howard has more than 30 years of experience in credit, risk management and financial reporting policies. She worked at Citigroup, Inc. from 2003 to 2011, serving as Chief Auditor from 2004 to 2011 and Global Head of Control and Emerging Risk from 2010 to 2011, leading a team of over 1,500 professionals covering $1.9 trillion of assets in over 100 countries, until her retirement in 2011. She was previously Managing Director of Capital Markets Audit at Fleet Boston Financial and a Managing Director at JPMorgan in the roles of Deputy Auditor and head of Global Markets Operational Risk Management. Ms. Howard is a certified public accountant in the United States and has over a decade of experience with KPMG and Ernst & Young.

Ms. Howard currently serves on the board of directors of Artisan Partners Fund, where she chairs the Audit Committee. Ms. Howard previously served on the board of directors of BMO Financial Corp., where she iswas a member of the Audit Committee, and the board of directors of BMO Harris Bank N.A., where she chairschaired the Directors’ Trust Committee and the Audit Committee. Ms. Howard also serves on the board of directors of Artisan Partners Fund.Committee, until April 2018.

1315

Thomas W. Jones

Independent Director

Director Since:2015

Committee Memberships:

Audit

|

|

Qualifications:

Mr. Jones’ background has given him extensive experience in investment management and in the operations of large financial institutions, which is valuable to the Board.Board as our Company expands its asset management business. His previous service on the boards of other financial services companies and the Federal Reserve Bank of New York adds value to the Board and Board committee deliberations.

Biography:

Mr. Jones, age 68,70, became a director of AGL in August 2015. Mr. Jones is the founder and senior partner of venture capital firm TWJ Capital LLC. Prior to founding TWJ Capital in 2005, he was the chief executive officer of Global Investment Management at Citigroup, which included Citigroup Asset Management, Citigroup Alternative Investments, Citigroup Private Bank and Travelers Life & Annuity. Earlier, he held a series of positions at TIAA-CREF, including vice chairman and director, president and chief operating officer, and executive vice president and chief financial officer, and at John Hancock Mutual Life Insurance Company, where he rose to senior vice president and treasurer. He began his career in public accounting and management consulting, primarily at Arthur Young & Company (predecessor to Ernst & Young).

A trustee emeritus of Cornell University, Mr. Jones has served on numerous boards in the past, including those of the Federal Reserve Bank of New York (where he was vice chairman), Altria Group, Freddie Mac, Travelers Group, Fox Entertainment Group, Pepsi Bottling Group and TIAA-CREF. Mr. Jones has been designated Board Leadership Fellow by the National Association of Corporate Directors (NACD), and is a licensed Certified Public Accountant (CPA).

Patrick W. Kenny

Independent Director

Director Since:2004

Committee Memberships:

Compensation (Chair)

Nominating and Governance

Executive |

|

Qualifications:

Mr. Kenny has extensive insurance industry experience, including executive experience within the industry. In addition, the Board benefits from Mr. Kenny’s experience serving as a Board member of several Voya funds as our Company expands its asset management business, as well his experience as an accountant.

Biography:

Mr. Kenny, age 75,77, became a director of AGL upon completion of our 2004 initial public offering. He served as the President and Chief Executive Officer of the International Insurance Society in New York, an organization dedicated to fostering the exchange of ideas through a program of international seminars and sponsored research, from 2001 to 2009. From 1998 to 2001, Mr. Kenny served as executive vice president of Frontier Insurance Group, Inc. From 1995 to 1998, Mr. Kenny served as senior vice president of SS&C Technologies. From 1988 to 1994, Mr. Kenny served as Group Executive, Finance & Administration and Chief Financial Officer of Aetna Life & Casualty.